It’s been 35 years since the natural gas markets became deregulated. During that time, the reliance on natural gas as a heating source and an exportable commodity to the rest of the world has grown exponentially. While there are multiple factors affecting natural gas prices on a daily basis, two main drivers that have evolved in recent times are winter weather in the United States, as well as the growing LNG trade with Europe and Asia.

One only has to look at the significant impact to natural gas prices trading at multiples of 30, 40 or even 50 times during Winter Storm Uri in February 2021. The start of the Russian-Ukraine last year was another shock to US natural gas prices as Europe was exposed to a dramatic loss of supply from its top natural gas exporter – Russia.

Virtually every commodity procurement team has the same goals – to meet or beat budget, to untangle the complexity of the market, and to make confident decisions based on justifiable data. Here is how risk management specialists from StoneX navigate the uncertainty surrounding weather leading up to the December through March period, as well as forecasted growth in LNG exports approaching 50% over the next five years.

Winter weather

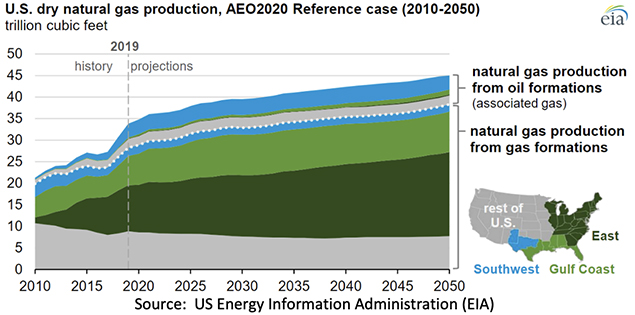

Although temperatures in the world continue to climb on an annualized basis (2023 will be the warmest on record), the impact of colder temperatures within a three-to-four-month span can dramatically increase residential heating demand. At the same time, the advent of shale drilling for natural gas has moved most US production onshore versus the Gulf of Mexico. The continued expansion of shale gas in the Northeast jeopardizes production freeze-offs when temperatures get too cold. This is a double whammy – colder temps lead to increased heating demand just as production freeze-offs reduce supply.

LNG exports

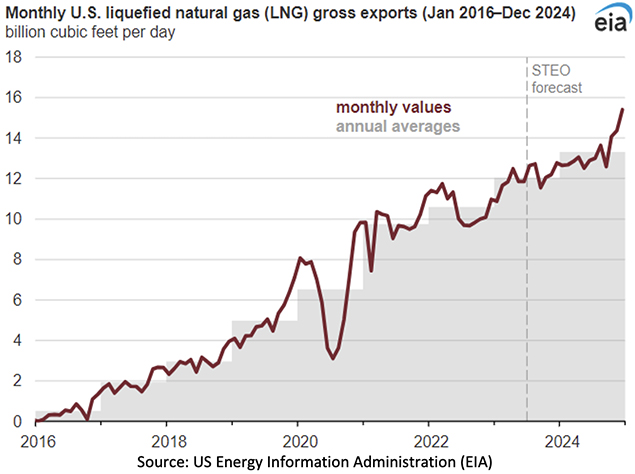

Seven years ago, US LNG exports were effectively zero. In 2023, the US joins Qatar and Australia as one of the top three exporters of LNG in the world. LNG exports currently run at about 14 BCF/day and are expected to grow to 22-27 BCF/day by the end of the decade. That’s natural gas that leaves the US every day. The expanding trade disagreements among countries will only bring more buyers to the US LNG market.

Hedge tools that manage these two disparate risks

Since we know there is not enough natural gas produced each day during the winter to service demand, supply that was bought during the summer is put into underground storage to help with peak demand requirements. An effective risk manager will look to protect the high volatility winter months with fixed-price purchases pre-winter and/or call purchases for a defined premium. A combination of these two hedge tools protects against weather-related price spikes while still allowing some downside participation in the event temperatures stay on the warm side.

While weather is difficult to forecast, the linear growth in LNG exports over the next 5-7 years is more predictable. Utilizing a methodical hedge matrix that defines “Value” (average over time) and securing some percentage of future years’ expected consumption below the average historical prices is a great way to stay in front of the market.

At StoneX, we help our clients be proactive with hedging objectives in a shorter timeframe (upcoming winter) while taking advantage of the physical and financial tools available for more defined long-term hedges. By establishing a disciplined approach to weather and LNG export price risks, a procurement team can leverage structure and clear support to make commodity purchasing decisions with confidence.

Contact our energy experts at StoneX to learn more about hedging tools to manage your natural gas, electricity or diesel price exposure. Email CCC@stonex.com and reference “Sosland Article” in your message.

You can also check the StoneX Controlling Commodity Costs Podcast to gain insightful market perspectives and understand industry best practices in managing price risk for energy as well as other commodities across your procurement portfolio.