KANSAS CITY — The center of store became the epicenter of surging food and beverage sales in 2020. In-home eating brought on by coronavirus (COVID-19) lockdowns provided the impetus. Along with increased sales, innovative new products hit the frozen food and soup categories while facility investments came in frozen pizza.

Packaged foods consumption in the week ended June 20 was up an average of 20% from the same period a year ago, according to New York-based Credit Suisse, which expected above-normal growth rates in packaged foods to persist in the second half of the year.

“We think the reacceleration demonstrates that consumers continue to eat more of their meals at home even though state governments have been lifting restrictions on restaurants and social distancing,” Robert Moskow, research analyst at Credit Suisse, wrote in Credit Suisse’s packaged foods research update issued June 22.

Consumers growing comfortable with working from home and those looking to save money during a recession also could keep at-home eating at elevated levels, said Nick Modi, managing director at RBC Capital Markets, in a July 9 webinar put on by Information Resources, Inc., a Chicago-based market research firm. He said a single individual could eat a meal for $15 at a restaurant versus $4 at home.

“If you have a family of four, just think about the implications of your wallet during a recession,” he said.

Frozen aisle activity

Frozen food sales growth in 2020 could continue into future years. Allied Market Research, which has a US office in Portland, Ore., forecast the global frozen food market to register a compound annual growth rate of 4.2% from 2020 to 2027 and reach $404.8 billion in sales.

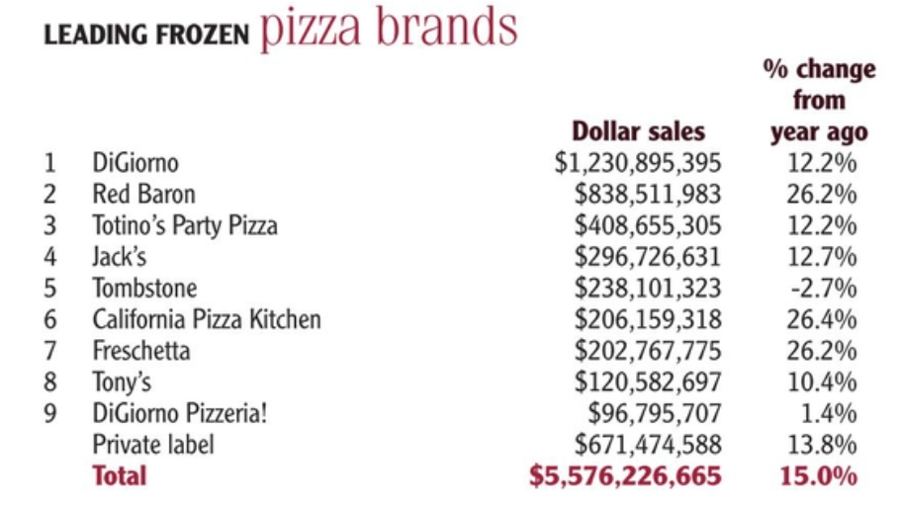

US retail sales of frozen pizza reached $5.58 billion in the 52 weeks ended July 12, up 15% from the previous 52-week period, according to IRI. Schwan Food Co. frozen pizza sales jumped 24% in the 52-week period to $1.16 billion, trailing only vendor leader Nestle USA at $2.21 billion, up 10%.

Bloomington, Minn.-based Schwan, a business unit of South Korean food manufacturer CJ CheilJedgang, plans to build a 400,000-square-foot expansion to its pizza plant in Salina, Kan. Work on the new production lines, shipping and receiving docks and office space is scheduled to begin in the expanded area in December 2022.

Bloomington, Minn.-based Schwan, a business unit of South Korean food manufacturer CJ CheilJedgang, plans to build a 400,000-square-foot expansion to its pizza plant in Salina, Kan. Work on the new production lines, shipping and receiving docks and office space is scheduled to begin in the expanded area in December 2022.

General Mills, Inc., Minneapolis, invested in frozen food as well. The company in August unveiled plans to upgrade a plant in Wellston, Ohio, that makes Totino’s pizza snacks.

In other frozen food categories, major brands introduced new products.

Conagra Brands, Inc., Chicago, registered US retail sales of $1.48 billion in single-serve frozen dinners entrees in the 52-week period ended July 12, up 12% from the previous 52-week period, according to IRI. The company, in its new product launches, combined its Gardein plant-based meat and chicken alternatives with items such as Birds Eye Voila! Skillets, Healthy Choice Power Bowls and Marie Callender’s pot pies.

B&G Foods, Parsippany, NJ, capitalized on the eating-at-home trend as well.

“During the second quarter, we experienced tremendous strength in almost all of our brands, with 85% of our brands growing in net sales versus a year ago, including Green Giant, Ortega, Clabber Girl, Cream of Wheat, McCann’s, Grandma’s Molasses and Victoria, to name a few,” said Kenneth G. Romanzi, president and chief executive officer, in a July 30 earnings call.

New York-based Nielsen reported that for the 13 weeks ended June 27, the total B&G Foods portfolio grew 34.5% versus a year ago in consumption through retailer checkout lanes.

Green Giant, the company’s largest brand, grew 45% in net sales in the second quarter. B&G Foods launched Cauliflower Breadsticks under the Green Giant brand in original and garlic flavors. They are gluten-free and made without artificial colors, flavors or preservatives.

Green Giant, the company’s largest brand, grew 45% in net sales in the second quarter. B&G Foods launched Cauliflower Breadsticks under the Green Giant brand in original and garlic flavors. They are gluten-free and made without artificial colors, flavors or preservatives.

“While we don’t expect these outsized growth numbers to continue forever, we do believe our sales trends will remain elevated as long as people are going to be sheltering or working a bit more from home, eating out a little less and eating at home a little more,” Mr. Romanzi said. “And quite candidly, we believe these trends will remain elevated for quite some time, even after the pandemic eventually moves on. Consumers are learning about and enjoying cooking at home, and our brands, our categories, are a perfect fit for them.”

Nestle USA enjoyed success with its Hot Pockets brand, the sales leader in frozen handheld entrees. US retail sales increased 14% to $789.7 million in the 52 weeks ended July 12, according to IRI. The company also has plans for its slumping Lean Cuisine brand.

“We just reimagined that business, relaunched Life Cuisine, which is underneath Lean Cuisine,” said Steve Presley, CEO of Nestle USA, on Sept. 9 in a virtual presentation at the Barclays Global Consumer Staples Conference. “And that business shows really good early signs that we’ll be able to turn that business around as well. So for us, it is a structurally attractive space. It is consumer-focused. Consumers actually have come back to the category in a big way pre-COVID, through COVID and we think post-COVID.”

Campbell innovation on tap

While US retail sales of ready-to-serve wet soup jumped 17% to $1.90 billion in the 52-week period ended July 12, US retail sales of condensed wet soup increased 14% to $1.61 billion, according to IRI.

Campbell Soup Co., Camden, NJ, has new product plans designed to keep sales growing. The company will expand its Swanson broth sipping line with two new flavored varieties: Chinese spice and Moroccan.

“We expect this line to attract younger consumers, particularly millennials and Gen Xers who value the ease and convenience of the sipping cup,” said Mark A. Clouse, president and CEO, in a Sept. 3 earnings call.

Launches in the Pacific Foods brand will include three condensed soup varieties in a can that are organic and gluten-free.

“As the trend of quick-scratch cooking continues to grow, these offerings will fit perfectly for consumers who want to save time and add organic and nutritious ingredients to their meals,” Mr. Clouse said.

A Slow Kettle toppers line with five flavors also is geared toward younger generations.

“We’ve tested this line at a national retailer and have found that it is bringing a new and younger consumer into the soup aisle,” Mr. Clouse said.

Conagra Brands, meanwhile, introduced Gardein plant-based soups: Saus’ge Gumbo, Chick’n Noodl’, Chick’n & Rice, Be’f & Vegetable, and Minestrone & Saus’ge.

Sauce sales accelerate

Rising sales in sauces helped Lancaster Colony Corp., Westerville, Ohio, to record net sales of $1.33 billion in the fiscal year ended June 30.

“Retail net sales benefited from higher demand as the impacts of COVID-19 drove increased at-home food consumption,” David A. Ciesinski, president and CEO, said during an Aug. 27 conference call with analysts. “We were pleased to see that our recent new product introductions contributed about 4.5 percentage points to our retail segment’s Q4 sales growth. Notable contributors to growth included our single-bottle offering of Buffalo Wild Wings sauces and, separately, Chick-fil-A sauces that we are selling in a regional pilot test in Florida.”