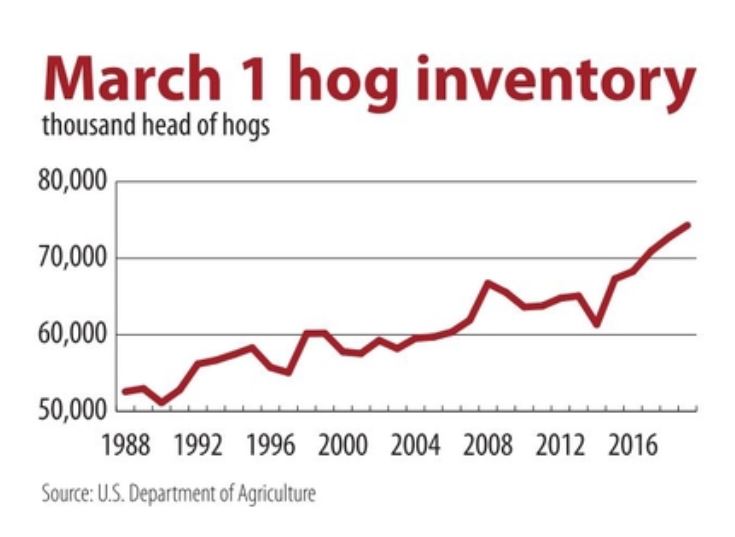

WASHINGTON — The U.S. hog and pig inventory has hit record highs for the date for 15 consecutive quarters, with the latest March 1 inventory of 74,296,000 head the highest March inventory ever and the third highest ever after Dec. 1, 2018, and Sept. 1, 2018, which was the all-time high at 75,136,000 head. As may be expected, pork production also has set records for months, and hog and pork prices have been under pressure, with profit margins for hog farmers in the red. But lean hog futures and cash pork prices have soared in recent weeks, giving hope to the beleaguered industry. And there are indications the pace of the multi-year herd expansion is slowing.

The CME Group May lean hog future set a contract low of $62.65 per cwt on Feb. 20 but surged 49% to a contract high of $93.25 per cwt on April 5. The June contract jumped 38% during the same period, and spot April soared 56% from Feb. 20 to March 27.

The U.S. Department of Agriculture’s hog carcass cutout value (an indication of wholesale pork prices) fell to a 10-year low of $57.16 a cwt during the week ended Feb. 22 and ended at $82.04 the week as of April 10 for a gain of 44% for the period.

University of Illinois agricultural economist Chris Hurt said lean hog carcass prices averaged $45.92 per cwt in 2018, the lowest annual average since 2009, and that cash hog prices in February 2019 averaged $39.04, the lowest for the month since 2003. The breeding herd has been expanding since mid-2014, Mr. Hurt said, with expansion peaking in early 2018. Hog numbers were nearing all-time highs just as export tariffs hit last year. Further, domestic demand was less than robust, in part due to consumers’ focus on beef in good economic times rather than on pork. About 22% of U.S. pork is exported compared to about 11% of U.S. beef production.

U.S. pork exports started last year strong, but “faded after retaliatory tariffs were placed by China (25%) and Mexico (10%),” Mr. Hurt said. Total U.S. exports were up 4.2% in 2018, but shipments to Mexico, the largest buyer of U.S. pork, were down 2%, and to China/Hong Kong were down 24% from 2017.

Just as trade issues contributed to the fall in hog and pork prices, so is trade pulling prices back up. The recent strength for the most part has been attributed to export optimism — a combination of hoped-for reduced tariffs on U.S. pork by Mexico and China and the loss of millions of hogs, largely in China, from African swine fever (A.S.F.).

Just as trade issues contributed to the fall in hog and pork prices, so is trade pulling prices back up. The recent strength for the most part has been attributed to export optimism — a combination of hoped-for reduced tariffs on U.S. pork by Mexico and China and the loss of millions of hogs, largely in China, from African swine fever (A.S.F.).

It has been estimated that A.S.F. has wiped out 20% of China’s 710-million-head hog herd, the largest herd in the world. Some estimates from outside China put losses much higher.

The U.S.D.A., in its April 9 World Agricultural Supply and Demand Estimates report, projected 2019 U.S. pork exports at 6,175 million lbs, up 0.8% from its March forecast and up 5% from 2018, while lowering from March its forecast for 2019 pork production at 27,339 million lbs, though still up 3.8% from 2018.

While the March Hogs and Pigs report contained bearish news about hog numbers, it also included some data suggesting supplies may be peaking. The report indicated sows farrowing during the December-February period were up 2% from a year earlier, with the pig crop up 3% due to record-high pigs per litter. But farrowing intentions for March-May were up only 1%, and June-August intentions were down slightly from last year, although both periods still were up 3% from 2017.

Also encouraging for producers is hog prices tend to rise in the spring due to seasonally lower slaughter numbers.